In early October, a shitstorm came down on Paypal after the company sent emails to its business customers announcing that as of 3 November, its Acceptable Use Policy (AUP) would be expanded to include, among other things, a prohibition on “sending, posting or publishing messages, content or materials that promote disinformation.” Paypal was supposed to be able to confiscate $2,500 from users’ accounts per violation. Many customers cancelled their accounts and there were lots of very critical comments on social media, including from Elon Musk and former PayPal president David Marcu, who tweeted, “A private company gets to take your money if you say something they don’t like. Insane.”

In response, Paypal apparently backed down on Oct. 9, announcing:

“An Acceptable Use Policy (AUP) notice recently went out in error that included incorrect information. PayPal is not fining people for misinformation and it was never intended to include this wording in our policy. Our teams are working to correct our policy pages. We are sorry for the confusion this may have caused.”

However, influential commentators on social media believe they have determined that Paypal secretly introduced the supposedly withdrawn new policy after all. They point to clauses in the company’s current User Agreement, which say that Paypal has a right to confiscate $2,500 or its equivalent in national currency from customer accounts per alleged violation of its Acceptable Use Policy. They also point to a clause in the User Agreement stating that it is not allowed to “provide false, inaccurate or misleading information” in connection with a Paypal account.

However, others note in the comment columns on such posts that these clauses are not new. That would make Paypal’s change announcement and subsequent withdrawal announcement seem unnecessary or misleading. Others say, that the $2500 dollar fine does not apply to a violation of the prohibition against misinformation.

My deep dive into archive versions and the current version of the User Agreements revealed: Paypal’s pronouncements were indeed misleading. The change announcement did not make clear what exactly was changing. And no one believed that the announcement was actually a mistake. Such a policy change is not announced in error in a corporation like Paypal. Also, the announcement of the withdrawal did nothing to clear up the confusion that had arisen, but rather used this confusion to obfuscate its own intentions. The confusion about the current state of affairs is due to highly complex and inconsistent terms and conditions and unexpected differences between the ones applying to the US versus Britain and the rest of Europe.

Summary of my findings

The terms and conditions of Paypal are – probably intentionally – so confusing that it takes a long time to figure out, what they say, and still, you cannot be sure. Here is a summary of the results of my research:

- Yes, Paypal does claim the right to confiscate $2,500 (or several times $2,500) from customer accounts if they think that business customers (sellers) have violated the Acceptable Use Policy. This has been in effect for years.

- The User Agreement for UK and other European customers is significantly more expansive in terms of what can be sanctioned with the $2500 fine than the agreement for US customers.

- Yes, Paypal might penalize you for voicing opinion or stating facts if they deem them inaccurate. This has also been true for a long time.

- No, the $2,500 liquidated damages don’t currently apply to “misleading or inaccurate information”, at least not in the US, but probably also not in Europe The amendment would indeed have changed that. However, it is almost impossible to definitively determine what applies in Europe. Penalties for violations are partly listed in the wrong place, and there are circular references between User Agreement and Acceptable Use Policy, both of which are part of the Terms and Conditions, but differ in terms of activities that are not allowed.

- The legal validity of the clauses and penalties is more than dubious.

- But that doesn’t matter much, because Paypal – regardless of objective legality – can confiscate or freeze money as it sees fit. Affected customers then have to take the expensive and risky legal route if they want to get it back.

1. Paypal may confiscate arbitrarily

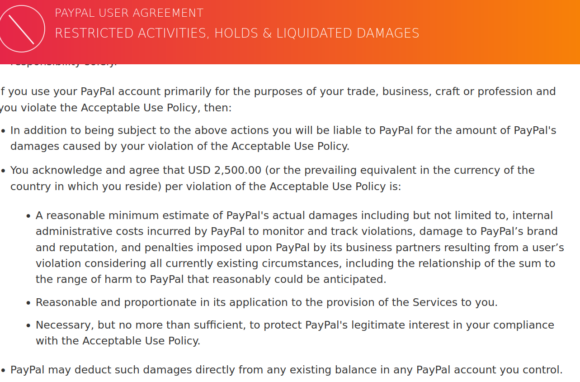

Paypal’s User Agreement for the UK states and has been stating or a while:

If you use your PayPal account primarily for the purposes of your trade, business, craft or profession and you violate the Acceptable Use Policy, then, in addition to being subject to the above actions you will be liable to PayPal for the amount of PayPal’s damages caused by your violation of the Acceptable Use Policy, you acknowledge and agree that USD 2,500.00 (or the prevailing equivalent in the currency of the country in which you reside) per violation of the Acceptable Use Policy is a reasonable minimum estimate of PayPal’s actual damages (…)”

Thus, Paypal has long made itself the prosecutor, judge and enforcer for an upwardly open penalty, as the $2,500 can be collected per violation. Paypal decides at its own discretion what counts as a single violation and what counts as multiple violations, just as it decides whether there is a violation or not.

The list of the prohibitions, the violation of which can result in drastic sanctions, is full of vague terms, so that Paypal can easily find an excuse for blocking accounts and freezing assets.

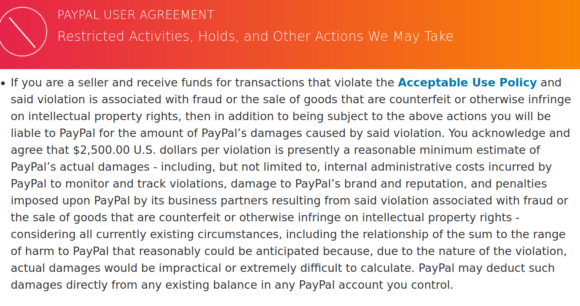

2. Different rules in the US

However, the conditions of applying the lump-sum damages of $2500 are a lot more restrictive in the US, where it says:

“If you are a seller and receive funds for transactions that violate the Acceptable Use Policy and said violation is associated with fraud or the sale of goods that are counterfeit or otherwise infringe on intellectual property rights, then in addition to being subject to the above actions you will be liable to PayPal for the amount of PayPal’s damages caused by said violation. You acknowledge and agree that $2,500.00 U.S. dollars per violation is presently a reasonable minimum estimate of PayPal’s actual damages (…).”

Thus, while in Europe, any violations of any prohibition in the Acceptable Use Policy, some of which very vaguely worded, can give rise to the liquidated damages of $2500 per violation, in the USA it is only the much more serious and much less vague ones involving fraud and violation of property rights that can lead to this grave sanction.

Note, however, that this restriction does not apply to the other sanctions, including termination of account and freezing of assets.

3. Financial penalties for disagreeable opinions…

The vaguely formulated prohibitions include the provision of misinformation, in Britain as well as in the US. The list of prohibited activities in the User Agreements says:

“In connection with your use of our websites, your PayPal account, the PayPal services, or in the course of your interactions with PayPal, other PayPal customers, or third parties, you must not: (…) provide false, inaccurate, or misleading information.”

A look into the Internet archive (Wayback Machine) reveals that the prohibition on providing misinformation has been in Paypal’s User Agreement for years.

Some people read this clause as only being about misleading product information. According to the wording, however, this is not the case. The clause does not mention products or services, and it is explicitly including “third parties”. Certainly, if publishers use a Paypal account, the product they are being paid for, is what they publish. If they have created the expectation, that they will publish facts and Paypal considers the information they actually provide to be misleading, the clause would directly apply.

Thus, it could suffice if a text of a publisher who receives user contributions via Paypal, is accused by one of the so-called fact checkers of “lacking context” or similar, in order for this publisher to be sanctioned by Paypal. Which sanctions will apply, is a complicated question.

4. … but not the $2500-damages

In order to find out, which punishment awaits insubordinate publishers, an almost investigative analysis of Paypal’s terms and conditions is necessary, at least as regards the rules applying to European customers.

The terms and conditions include the clauses of a User Agreement and the Acceptable Use Policy. They both contain a list of prohibited activities. The two lists overlap considerably, but they are of different lengths and are formatted very differently, so they are not easy to compare. The coexistence of two overlapping lists of prohibited activities is not explained, nor is their potentially different legal nature.

The prohibition of providing misinformation is only included in the list of restricted activities in the User Agreement.

The relevant chapter is called “Restricted Activities, Holds and Other Actions We May Take” in the US and “Restricted Activities, Holds and Liquidated Damages” in the UK. The chapter starts with the list of prohibited activities and continues with:

“If we believe that you’ve engaged in any of these activities, we may take a number of actions to protect PayPal, its customers and others at any time in our sole discretion. The actions we may take include, but are not limited to, the following: (…)”

A raft of measures, including account suspensions and freezing of funds, are then listed. Pretty far down in the list of sacntions comes a twist that is hardly noticeable to normally attentive readers, in that reference is no longer made to “these activities” but to “violations of the Acceptable Use Policy”.

It says, in the British User Agreement: “If you use your PayPal account primarily for your trade, business, or profession and violate the Acceptable Use Policy…”, then you could be subject to, among other things, a flat penalty of $2,500 per violation. At least according to the wording, this only refers to the prohibitions in the Acceptable Use Policy, which do not include the clause on misinformation.

Thus, going by the exact wording and interpreting it narrowly, the $2,500 liquidated damages do not currently apply to the spread of misinformation. The new policy that Paypal announced and then withdrew would have added providing misinformation to the Acceptable Use Policy’s prohibited list and explicitly subjected it to the $2,500 liquidated damages.

However, the Acceptable Use Policy and the User Agreement refer to each other and make it clear that one has to comply with both, or else one is considered to have violated them both. Therefore, Paypal, the prosecutor and judge, could argue that any violation of the User Agreement – including the spread of misinformation – is also a violation of the Acceptable Use Policy and thus punishable by the liquidated damages of $2500 per violation.

In the User Agreement applying to the US, things are clearer, as the User Agreement states that only violations of the Acceptable Use Policy having to do with fraud and property rights infringements can give rise to the liquidated damages (which are not called by that name in the US).

5. Legal validity is very questionable

In Germany, there I live, the clauses that Paypal uses, are almost certainly invalid. Both in contracts with consumers and in contracts with sellers, clauses in general terms and conditions (AGB) are invalid according to §307 BGB (Bundesgesetzbuch, civil law), if they disadvantage the contractual partner unreasonably. This is the case, if they allow the user to improperly assert his own interests at the expense of his contractual partner without taking sufficient account of the latter’s interests. Clauses, which violate essential basic ideas of legal regulations, are also ineffective.

The fact that Paypal makes itself the plaintiff, judge and enforcer of penalties, some of which very harsh, without any eyplicit regard to the interests of the customers, should very clearly fulfill these criteria.

§309 para 1 No. 5 BGB states (my translation) that “the agreement of a lump-sum claim of the user for damages (…) is invalid, if (…) the other party to the contract is not expressly allowed to prove that no damage or diminution in value was incurred at all or that it was significantly lower than the lump sum”.

This seems to apply directly to the $2,500 liquidated damages in Paypal’s User Agreement for Germany.

In 2014, Paypal committed itself to the Federation of German Consumer Organizations (vzbv) to cease and desist from numerous formulations in its terms of use. The vzbv had sued the company before the Berlin Regional Court, complaining that many Paypal terms and conditions were opaque and unreasonably disadvantaged the customer. The main points at issue were clauses under which the company reserved the right to block payments and freeze credit balances until a risk assessment had been completed. The vzbv had objected to a total of 20 clauses in the terms of use.

The vzbv informed me that they are currently suing Paypal again for using clauses that unreasonably disadvantage customers, including with clauses, which allow Paypal to close accounts at will and to freeze remaining funds for an insufficiently specified length of time,

6. Only those who sue get their money back

However, Paypal uses its position of power as account administrator in a way that makes the difference between valid and invalid clauses and their correct or incorrect interpretation almost insignificant for customers. Whereas rule of law would normally require obtaining a court order to forcibly recover damages from others, Paypal turns that around. Those who disagree have to find a lawyer and go to court to get the money back that Paypal has taken, justified by little more than the fact that they can.

Paypal is famous for liberally using its right to freeze a customer’s funds. Regularly, the company ignores protests and only reacts when a customer sues, and even then often only when an expected negative verdict is approaching. Then the money is released again and the customer is left sitting on the legal costs, unless he takes the risk of suing again.

By way of comparison: many German banks have recently terminated the accounts of insubordinate publishers and activists with notice. That is alarming enough. However, to my knowledge, they never have blocked accounts with immediate effect or even frozen assets, without good cause.

Why does Paypal do this?

One can assume that Paypal did not develop the urgent desire to censor the public statements of its customers on its own. Paypal’s current actions to “combat disinformation” range from account suspensions for publishers, publications, and organizations such as Boris Reitschuster, Daily Secptic, and Free Speech Union, to the retracted threat of the $2,500 fine for insubordinate publishing. These actions are likely due to pressure from the EU and governments, which are working to expand the privatized censorship regime and make it watertight by cutting off undesirable publications and publishers from all means and ways to finance their work.

A very illuminating article on this topic appeared on tkp.at on October 17 (in German). The article quotes guidelines of the EU Commission from 2021 with the intention:

“Measures to stop disinformation should be extended by involving actors active in the online monetization value chain, such as online e-payment services, e-commerce platforms and relevant crowdfunding/donation schemes.”

That’s exactly what’s happening right now in a variety of ways. Since Paypal and Co. rely on authorities ignoring their manifold violations of European law, for example data protection law or property rights (account looting), they are not resolutely resisting the request to become part of the censorship machine. Only when customer reactions become too negative, as recently, do they back down. For sure, talks between the EU Commission and Paypal are already öngoing in the background on how to achieve the desired result without causing further commotion.

It will be important how customers react. Although the market power of Paypal is very large, there are alternatives. I canceled my account with Paypal back in 2015, when the company introduced new terms and conditions in a legally very questionable way that gave it a broad right to share and sell detailed customer identity and financial data to a variety of companies around the world.

As an aside: Paypal’s chief executive, Dan Schulman, is a member of the steering committee of the Council for Inclusive Capitalism with the Vatican, which ostensibly seeks to ensure that a chastened capitalist system benefits everyone. Schulman’s profile at the council says he is “focused on democratizing and transforming financial services and e-commerce to improve the financial health of billions of people, families and businesses around the world” Pope Francis apparently does not know or does not mind that Schulman interprets this commitment liberally as freezing peoples accounts and looting their money at will and gives his blessing anyway.